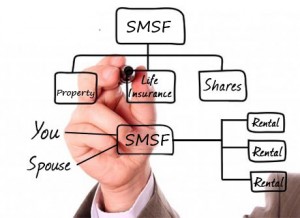

Self Managed Super Fund

If you have a Self -managed Super fund, are you aware that SIS Reg 4.09((2)(e)) requires trustees of SMSF’s to consider whether insurance cover should be held by the fund on the members lives and you need to review that decision regularly as part of the funds’ investment strategy?

Self-Managed Superannuation Fund Life Insurance Cover is suitable for trustees of self managed superannuation funds to consider for members of the fund. SMSF life insurance cover pays a lump sum benefit on the death or Terminal Illness of an insured member. You also have the option to apply for Total and Permanent Disability (TPD) cover, for even greater protection and peace of mind.

For most types of SMSF (self-managed superannuation funds), life insurance is available as an option that is paid out of the fund premiums.

A handy strategy for a trustees of a SMSF to consider if illiquid assets like real estate are held in the fund to cover member benefits is for the fund to own life cover on the members so that benefits can be paid out in the event of death without the need to sell or dispose of fund assets especially where the market timing of a sale would disadvantage other members.

This can be a very complex area so please contact your Accountant or a specialised professional .

We can assist with implementation of your decision regarding insurances after speaking with your Accountant.

General Advice Warning:

The information contained within this website does not consider your personal circumstances and is of a general nature only. You should not act on it without first obtaining professional financial advice specific to your circumstances or you may make a decision that is not in your best interests.